The Anatomy of a Nigeria 419 Scam Against DJs

Disc jockeys and other event professionals are being targeted by international criminals attempting to defraud us of our hard-earned money. These criminals are increasingly sophisticated. The number “419” refers to the section of the Nigerian Criminal Code dealing with fraud.

In this blog, I share a recent encounter with a scammer and how they attempted to defraud our company of $1,450. The article concludes with a list of “red flags” suggesting that you are at risk of being the victim of a Nigeria 419 scam.

The Approach

A month ago, our company received a lead via The Knot from what looked to be a normal wedding couple seeking wedding DJ services. The lead from a Mr. Shane Rovers was inquiring about availability and pricing for his Friday, November 11, 2017 wedding at The Rose Bank Winery in Newtown, PA. Other than the late nature of the booking, nothing seemed out of the ordinary. He even had an authentic looking gmail address.

We responded to Mr. Rovers with our pricing and he agreed to book a basic package for $1,400. At that point, Shane began acting strangely, mentioning that he lives in Canada and is not allowed access to phone calls. However, he was very much interested to send us payment in full. We played along, asking for the information needed to complete the contract and providing an address to send payment. We didn’t hear from Rovers again for two weeks.

A week ago, he re-established contact by email and said that the check was on its way via his assistant. However, “there is a little mix up from her. She was supposed to send out two checks today, one for you and one for the wedding planner. She mistakenly sent the whole payment to you. Please, I will really appreciate it you could deduct your deposit and help send out the remaining funds to the wedding planner. Your help will be greatly appreciated.”

The FedEx Package Arrives

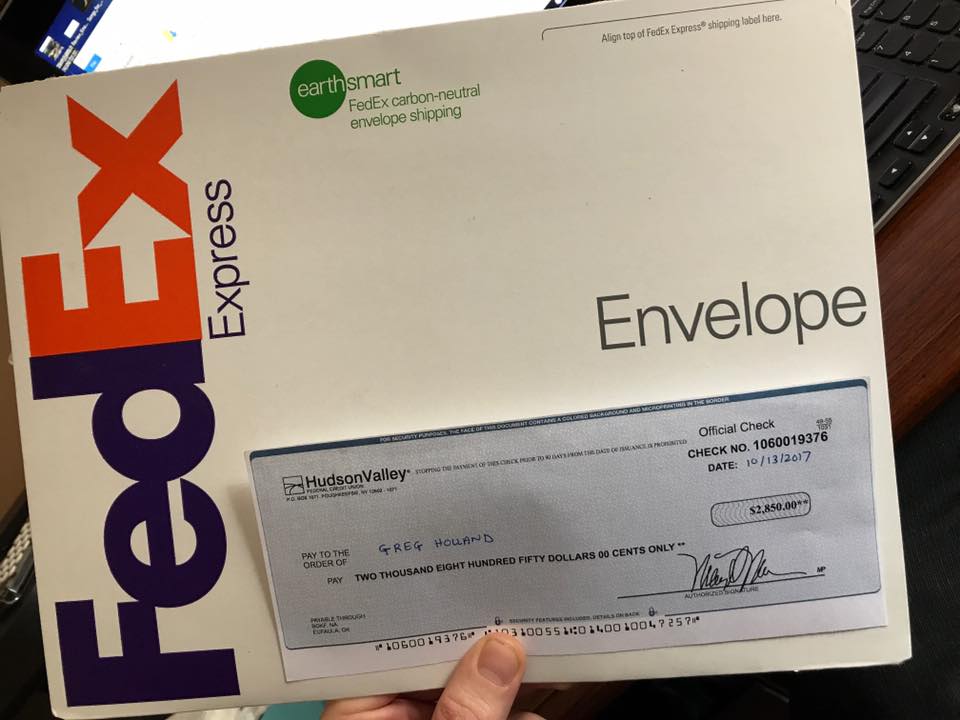

Last Friday, a FedEx package arrived on my doorstep, sent from a Gwen Beattie in Haymarket, Virginia. Inside the package was a very official looking check for $2,850. The check was supposed to be written to our company name, but was mistakenly written to “Greg Holland” (a poor misspelling of “Gregg Hollmann”). Several hours later, I received an eager email from Shane Rovers:

“How are you doing over there? Great i hope? I just got a confirmation from Fedex that the check will get to you today. Here is the tracking number…7704 8605 1481. Please deposit the check in your bank as soon as you recieve it and when it clears please kindly walk to a walmart near you and tell the cashier you want to make a walmart to walmart Transfer to this information below

Name…Kimberly XXXXX (Editor: last name deliberately omitted)

Address…..XXXX Herndon st, (Editor: street # deliberately omitted)

Bakersfield, California 93312″

Note: I suspect that “Kimberly XXXX” is another person whose identity has been stolen. Most likely an individual with a fake ID bearing her name and address claims the money on the other end.

After conferring with my consigliere, it was agreed that the best course of action was to disassociate from “Shane Rovers.”

The Disassociation

The next day after receiving the FEDEX, I sent out this email:

Shane Rovers,

I received the check. However, it was not written to “Ambient DJ Service” as requested.

It was written to “Greg Holland” – this is not my name. I cannot cash the check.

I will not be cashing the check and have written VOID on it in big black marker (see attached photo to this email).

Do not send me a replacement.

I do not feel comfortable with this transaction whatsoever with the wedding in Pennsylvania, you requesting me to send money to a supposed wedding planner based in California, with the FedEx sent from Virginia, and you supposedly based in Canada. It has all of the characteristics of a Nigeria 419 scam.

I do wish you well on your wedding day.

Please do not contact me again.

Sincerely,

Gregg

This response did not elicit any reply from Shane Rovers. Good. I guess he knows that this potential victim is a lost cause.

The research that I’ve done on Nigeria 419 scams indicates that the Africans do have U.S.-based actors to help execute these scams. I don’t recommend antagonizing these potentially dangerous individuals.

The Aftermath

I still had some unanswered questions. First, was the check that I received a counterfeit? So I called Risk Mitigation Department of Hudson Valley Federal Credit Union whose name was on the $2,850 check. They asked for the check number and determined that it was a fraudulent check.

Second, what would have happened if I deposited that check? There is a possibility that it would not have immediately bounced, and that the funds would be made available to my account. Scammers are known to use authentic bank account numbers that have real funds behind them. The fraudulent nature of counterfeit checks can take some time to uncover, at which time the bank would debit the amount of the check from your account. If you were gullible enough to send funds to the third party in the interim (in our case, “the wedding planner”), you would be out of this money.

A more eloquent explanation of the banking details is provided on Wikipedia:

The use of checks in a scam hinges on the practice or law in many countries concerning checks: when an account holder presents a check for deposit, the bank will usually make the funds available to the account holder within 1–5 business days, although checks, particularly if international, may take longer than that to clear. The clearing process may take 7–10 days, and can take up to a month when dealing with foreign banks. The time between the funds appearing as available to the account holder and the check clearing is known as the “float”, during which time the bank could technically be said to have floated a loan to the account holder to be covered with the funds from the bank clearing the check. Even after it has cleared, funds may be reclaimed much later if fraud is discovered.

The check given to the victim is typically counterfeit but drawn on a real account with real funds in it. With correct banking information a check can be produced that looks genuine, passes all counterfeit tests, and may initially clear the paying account if the account information is accurate and the funds are available. However, whether it clears or not, it eventually becomes apparent either to the bank or the account holder that the check is a forgery. This can be as little as three days after the funds are available if the bank supposedly covering the check discovers the check information is invalid, or it could take months for an account-holder to notice a fraudulent debit.

Regardless of the amount of time involved, subject to certain limits, once the cashing bank is alerted the check is fraudulent, the transaction is reversed and the victim’s account debited; this may lead to it being put in overdraft.

In doing some internet research, we also discovered another victim of fraud in this scheme. Gwen Beattie, the sender of the FedEx is a real baker and complained on Twitter this morning that she found $150 of fraudulent FedEx charges on her credit card account. Shameful! We touched base with Gwen. She was grateful to hear from us and apparently FedEx has been very accommodating to her situation.

10 Red Flags for the DJ – Nigeria 419 Scam

- Event dates and durations that are atypical (e.g, a nine hour wedding on a Tuesday).

- Poorly written English that is overly polite with haphazard punctuation and odd phrases such as “walk to a Wal-Mart near you” and “God Bless You”

- A lack of interest in service details and packages.

- Lack of interest in signing a contract.

- A fixation on financial matters and payment methods.

- A sense of urgency to send you money.

- Preference for email communication and avoidance of phone conversation.

- The introduction of third parties who they would like you to pay on their behalf as a favor. A sense of urgency to pay these people quickly.

- Odd looking email addresses with strange domain names.

- Odd prospective client names – often British sounding.

Hudson Valley Credit Union, on its website, shares a list of “Red Flags for Fraud” that can be viewed at https://www.hvfcu.org/Online-Services/Safe-Computing/Red-Flags-for-Fraud

In Conclusion

I believe that most wedding professionals have the common sense not to take a proposed transaction such as this to its ugly completion. However, it’s important to stay vigilant as scammers are refining their scripts and on average getting more believable. One of the scarier aspects of the schemes is that they use publicly available data to impersonate real people.

My best advice to those who think they are being targeted by a scammer is to disassociate as quickly as possibly. Block them. Nothing good can come from their overtures.

Report these scams to law enforcement officials if you like, but good luck catching these criminals who are most likely based offshore in shadowy Third World internet cafes.

Ambient's boutique-style service offers distinct specialties in wedding receptions, corporate events and sensational teen dance parties.

book nowThe Best DJ Entertainment Services In New Jersey

Photo Booth

Photo Booths are an incredibly popular option for weddings and…Read More

Silent Disco

A silent disco features a DJ spinning, but instead of…Read More

Live musicians

A DJ spinning the pre-recorded songs that you know and…Read More

Lip Sync Battle

Let Ambient DJs host and emcee your next lip sync…Read More

Videography

With a professionally shot and edited video, the sights and…Read More

Custom Lighting

Lighting has the power to transform an event space from…Read More

Custom DJ Booth & Stage Design

Ambient DJs offers a variety of cool DJ booth and…Read More